what does it mean to be tax deferred

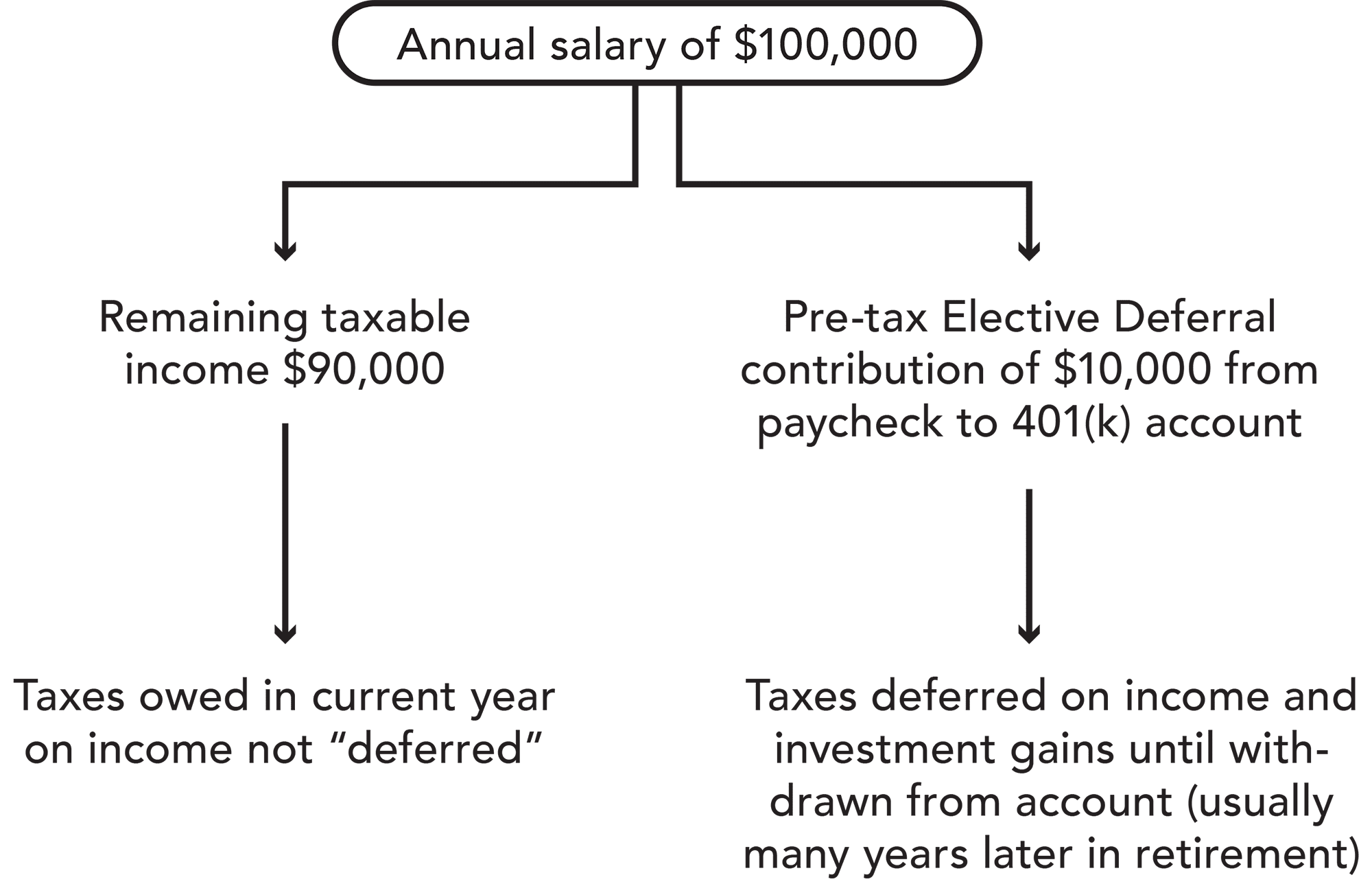

Instead of paying taxes first and then depositing funds into a retirement account a tax. Tax deferral means that you dont owe taxes that year on the money you just contributed so if you contribute in 2016 your 2016 tax bill is reduced but you will owe taxes.

Tax Deferred Grows Your Retirement Plan Faster

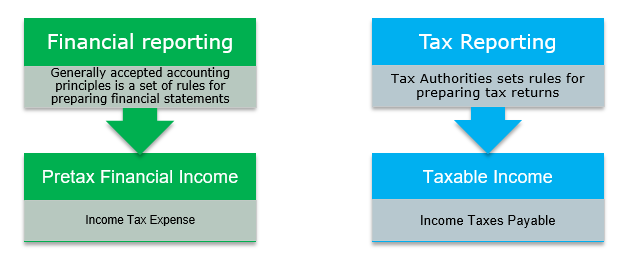

Deferred tax refers to either a positive asset or negative liability entry on a companys balance sheet regarding tax owed or overpaid due to temporary differences.

. Tax-deferred refers to earnings such as those in a traditional retirement account that accumulate tax-free until you withdraw funds from the account. In other words it is the difference between. When goods or services are delivered deferred revenue.

Tax deferred means that the tax that a person or company will need to pay on investments revenues or profits will be deferred to a future point in time. Keep track of your. Tax deferred is an instance where investment earnings such as interest dividends or capital gains accumulate tax-free until the payment of taxes related to the investment is.

A deferred income tax is a liability recorded on a balance sheet resulting from a difference in income recognition between tax laws and the companys accounting methods. A tax-deferred savings plan is an investment account that allows a taxpayer to postpone paying taxes on the money invested until it is withdrawn in retirement. This allows assets to grow faster and reduces tax liability.

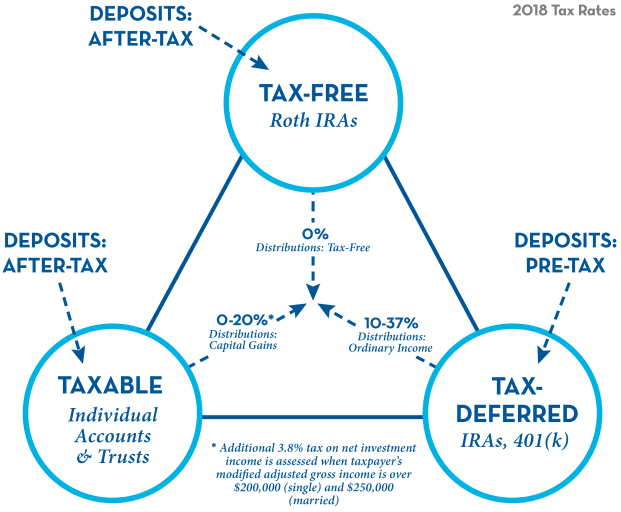

Tax free - the account grows tax free and. A permanent difference is the difference between the tax expense and tax payable caused by an item that does not reverse over time. Deferred tax arises when there is a.

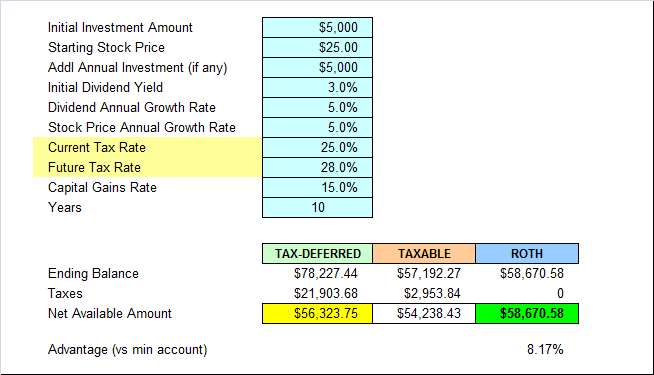

Tax deferred - you dont pay tax on gains each year as the it grows you pay tax only when withdrawn think traditional 401k traditional IRA. What Is Tax Deferral. With a tax-deferred account you get an up-front tax deduction for contributions you make your money grows untouched by taxes and you pay taxes later on your withdrawals.

In accounting terms deferred revenue is classified as a liability because it represents a future obligation. Tax Deferred Definition Tax-deferred refers to investment earnings on which income taxes and capital gains taxes are paid at a future date instead of the period they are incurred. Tax deferral means not paying federal income tax now but in the future when you take withdrawals from your retirement savings account like a 401k IRA or.

This can be beneficial because it allows you to. Deferred tax is the gap between income tax determined by the companys accounting methods and the tax payable determined by tax authorities. Tax deferral is a tax-strategy that pushes out the due date on taxes for gains on an investment.

Tax deferral simply means putting off paying your tax till sometime later in the future when it is more favorable for you. Tax deferred simply means that you are allowed to postpone paying taxes on an asset such as an investment until a later date. Tax-deferred refers to retirement accounts that delay the tax obligation of the account holder.

In the investment world tax deferred refers to investments on which applicable taxes typically income taxes and capital gains taxes are paid at a future date instead of in the. In other words tax. Tax-deferred status refers to investment earnings such as interest dividends or capital gainsthat accumulate tax-free until the investor takes constructive receipt of the profits.

For example if you purchase a property for 300000 and five years later sell it for 350000. When a taxpayer is said to have deferred their taxes. Tax-deferred accounts allow investments to grow tax-free until some point in the future sometimes indefinitely.

What Does Tax Deferred Mean Supermoney

Chapter 11 Retirement And Other Tax Deferred Plans And Annuities Ppt Download

Tax Efficient Fund Placement Bogleheads

What Is An Elective Deferral Clydebank Media

Deferred Tax Liabilities Meaning Example How To Calculate

Tax Deferred Vs Tax Free Investment Accounts David Waldrop Cfp

Net Operating Losses Deferred Tax Assets Tutorial

Deferred Income Tax Liabilities Explained With Real Life Example In A 10 K

What Does The Executive Action Deferring Payroll Taxes Mean For Employers And Employees Yhb Cpas Consultants

What Is The Benefit Of Tax Deferred Growth Great American Insurance

What Is A Tax Deferred Retirement Plan Pure Financial

Tax Deferred Vs Tax Exempt Retirement Accounts

Net Operating Losses Deferred Tax Assets Tutorial

Taxes Pay 15 Now Or 25 Later Seeking Alpha

Tax Deferred Accounts Are Valuable If They Aren T Your Sole Savings Strategy Provident Cpa Business Advisors

The Hierarchy Of Tax Preferenced Savings Vehicles

How Much Does Tax Deferral Save You Cody A Ray

What Does Tax Deferred Mean Explained All You Need To Know

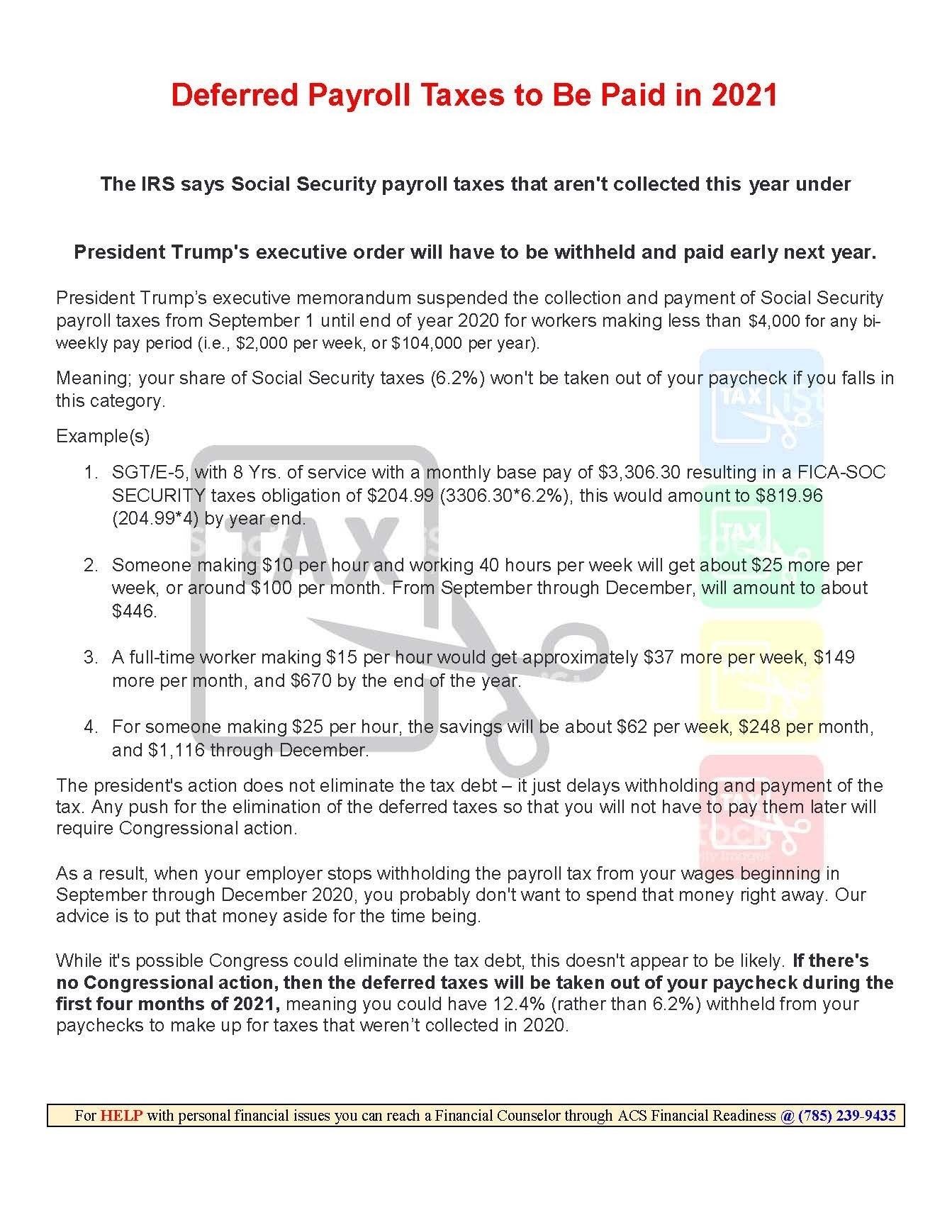

Old Age Survivors And Disability Insurance Taxes Deferred For Now Article The United States Army